Weltrade vs XM: Which Broker Should You Choose?

Choosing the right forex broker can make or break your trading career. You’ve probably spent countless hours researching different platforms, reading reviews, and comparing features.

Two names that keep popping up in your research are Weltrade and XM – both promising excellent trading conditions, but which one truly delivers?

Weltrade vs XM represents one of the most common broker comparisons in the forex community. Both brokers offer competitive features, but they cater to different types of traders.

Whether you’re a beginner looking for your first trading account or an experienced trader seeking advanced features, understanding the key differences between these platforms is crucial.

But here’s what most comparison articles won’t tell you about these brokers.

WELTRADE VS XM BROKER KEY DIFFERENCES SUMMARY

Account Variety: XM offers six account types vs Weltrade’s four Minimum Deposit: Both start at $1-5, but Weltrade’s SyntX offers unique value Maximum Leverage: Weltrade wins with 1:10000 vs XM’s 1000:1 Trading Competitions: XM offers demo competitions; Weltrade currently has no trading competitions

For traders considering other broker comparisons, you might also want to explore Weltrade Vs Alpari to understand how Weltrade compares across different competitive landscapes.

DETAILED BROKER SUMMARY

XM Broker Overview

XM positions itself as a comprehensive trading solution with something for everyone.

Their strength lies in variety – from the $5 minimum deposit Standard Account to the $10,000 Shares Account. The broker excels in:

- Accessibility: Low minimum deposits across most accounts

- Innovation: Proprietary mobile app alongside MT4/MT5

- Engagement: Monthly competitions and educational programs

- Flexibility: Six distinct account types for different needs

XM’s approach favours traders who want options, educational support, and engaging features beyond basic trading.

Weltrade Broker Overview

Weltrade takes a more focused approach, emphasising simplicity and unique trading opportunities. Their standout features include:

- Ultra-Low Barriers: $1 minimum deposit on Micro and SyntX accounts

- Extreme Leverage: Up to 1:10000 on SyntX accounts

- Innovative Instruments: Synthetic indices with 24/7 availability

- Streamlined Choice: Four account types covering all trader needs

Weltrade appeals to traders seeking either very low-cost entry or unique trading instruments not available elsewhere.

ACCOUNT TYPES: VARIETY VS SIMPLICITY

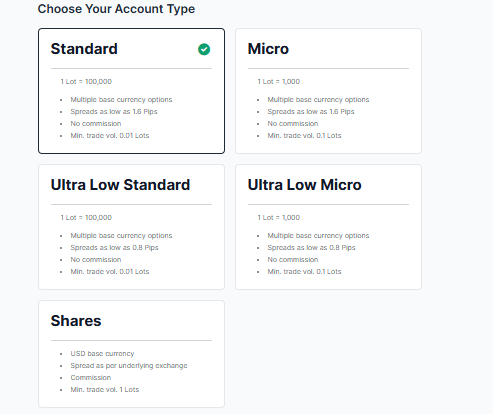

XM Account Options

XM offers a comprehensive range of account types designed for different trading styles and experience levels:

- Minimum deposit: $5

- Spreads: As low as 1.6 pips

- Maximum leverage: 1000:1

- Perfect for beginners who want bonuses and risk protection

- Minimum deposit: $5

- Spreads: As low as 0.8 pips

- Maximum leverage: 1000:1

- Ideal for high-volume traders seeking reduced costs

Micro Account

- No commission structure

- Spreads: As low as 1.6 pips

- Suitable for small-scale trading

Ultra Low Micro Account

- Spreads: As low as 0.8 pips

- No commission fees

- Perfect for cost-conscious micro lot traders

Shares Account

- Minimum deposit: $10,000

- Maximum leverage: 1:1

- Designed for stock market investments

Islamic Account

- Sharia-compliant trading

- No swap fees or interest charges

- Conversion processed within 24 hours

Weltrade Account Structure

Weltrade takes a more streamlined approach with four distinct account types:

- Minimum deposit: $1

- Trading currency: USD/EUR cents

- Leverage: 1:33 to 1:1000

- Perfect for beginners with limited capital

Premium Account

- Minimum deposit: $25

- Trading currency: USD/EUR

- Leverage: 1:33 to 1:1000

- Comprehensive trading tools included

Pro Account

- Minimum deposit: $100

- Floating spreads from 0.5 pips

- Leverage: 1:1 to 1:1000

- Direct market access for experienced traders

- Minimum deposit: $1

- Leverage: Up to 1:10000

- Synthetic indices trading

- 24/7 trading availability.

TRADING PLATFORMS AND TECHNOLOGY

Both brokers support MetaTrader 4 (MT4) and MetaTrader 5 (MT5), the industry-standard platforms.

However, XM goes a step further by offering their proprietary XM app, providing additional flexibility for mobile traders.

Weltrade focuses on the proven MT4 and MT5 platforms, ensuring reliability and familiarity for most traders.

The broker’s emphasis on platform stability over innovation appeals to traders who prefer tested solutions.

Spreads and Trading Costs

XM Spreads:

- Standard accounts: From 1.6 pips

- Ultra Low accounts: From 0.8 pips

- Variable spreads based on market conditions

Weltrade Spreads:

- Pro Account: From 0.5 pips (floating)

- Other accounts: Competitive variable spreads

- Focus on transparency in pricing

Weltrade’s Pro Account offers the tightest spreads, making it attractive for frequent traders. XM’s Ultra Low accounts provide competitive pricing but with higher minimum requirements for optimal conditions.

LEVERAGE AND RISK MANAGEMENT

XM offers leverage up to 1000:1 across most account types, providing substantial trading power. However, their approach to risk management includes bonus systems that help protect trader capital.

Weltrade’s standout feature is the SyntX Account with leverage up to 1:10000 – the highest in the industry.

This extreme leverage comes with synthetic indices that aren’t influenced by world events, offering unique trading opportunities.

DEPOSIT AND WITHDRAWAL METHODS

XM Payment Options:

- Multiple deposit methods

- E-wallets support

- Cryptocurrency options

- Local bank transfers

- Credit/debit cards

Weltrade Payment Methods:

- Standard banking options

- Multiple currency support

- Competitive withdrawal processing times

XM clearly leads in payment variety, especially with cryptocurrency integration, making it more accessible for international traders.

UNIQUE FEATURES AND BENEFITS

XM Special Features

Copy Trading System: XM’s copy trading platform allows beginners to mirror successful traders’ strategies, providing a learning opportunity while potentially generating returns.

Monthly Competitions: Over $100,000 in cash prizes monthly through various trading competitions:

- Demo Weekly (no entry fee)

- Paid Demo competitions

- Real trading contests

Educational Resources Comprehensive educational materials, webinars, and market analysis help traders improve their skills.

Weltrade Unique Advantages

SyntX Trading Synthetic indices provide unique benefits:

- 5-10 times lower spreads than traditional instruments

- Up to 8 times higher volatility than gold

- 24/7 trading including holidays

- Mathematical models unaffected by world events

Beginner-Friendly Approach With accounts starting at just $1, Weltrade removes barriers for new traders entering the market.

REGULATORY STATUS AND SAFETY

Both brokers maintain regulatory compliance, but the specific jurisdictions and regulatory standards differ.

XM operates under multiple licenses across different regions, while Weltrade focuses on specific regulatory frameworks.

CUSTOMER SUPPORT COMPARISON

XM Support:

- 24/7 multilingual support

- Multiple contact methods

- Extensive FAQ section

- Live chat functionality

Weltrade Support:

- 24/7 customer service

- Multiple language support

- Dedicated account managers for premium clients

- Technical support for platform issues

Both brokers offer round-the-clock support, but XM’s larger infrastructure provides more support channels and faster response times.

WHICH BROKER SHOULD YOU CHOOSE?

Choose XM if you:

- Want extensive educational resources

- Enjoy trading competitions and bonuses

- Need multiple payment options including crypto

- Prefer a broker with comprehensive account variety

- Value engaging community features

Choose Weltrade if you:

- Seek ultra-high leverage opportunities

- Want to trade synthetic indices

- Prefer simplicity over complexity

- Need 24/7 trading regardless of market holidays

- Value tight spreads and low costs.

CONCLUSION

The Weltrade and XM broker comparison reveals two distinct approaches to forex trading. XM offers a comprehensive, engaging platform with extensive educational support and variety.

Weltrade provides focused, innovative trading solutions with unique instruments and extreme leverage options.

Your choice ultimately depends on your trading style, experience level, and specific needs. Both brokers offer legitimate, regulated services, but they cater to different trader personalities and strategies.

Ready to start trading? Research both platforms thoroughly, consider opening demo accounts to test their features, and choose the broker that aligns with your trading goals.

Remember, the best broker is the one that supports your trading success, not just the one with the most features.

Have you tried either broker? Share your experiences in the comments below and help fellow traders make informed decisions.

English

English

German

German  Italian

Italian  Hi, User

Hi, User

Post a Reply

You must be logged in to post a comment.